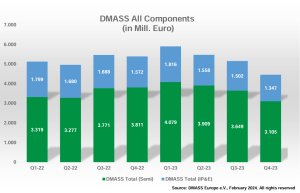

DMASS chairman, Hermann Reiter, said that the good performance in the first half of 2023 softened the blow of the slowdown. “Admittedly, distribution revenues were driven by orders and sales brought forward from 2024, inflating 2023 results significantly,” he said. “We are now facing a market contraction which bring the business back in line with long-term growth averages. Our hope for 2024 resides with an overall market upside through the hype around [AI] that could pull the entire market along. For Europe in general and components distribution and their customers in particular this effect will occur at best towards the end of 2024. The focus of distributors now must be on helping our customers to develop new markets”.

Across the DMASS membership, only Turkey and Romania saw growth, with Germany and Austria each seeing a drop of +18%. The most dramatic fall was Israel, with a 27% decline. Reiter made the point that although the downwards trend was foreseen, other factors cannot. “The challenges and opportunities in this market have become less readable than in the past and the dynamics today are influenced by political as well as technological factors that are by nature disruptive, possibly in both directions. Unpredictability notwithstanding, we are convinced that distribution will remain the stabilising and balancing force in the market,” he said.